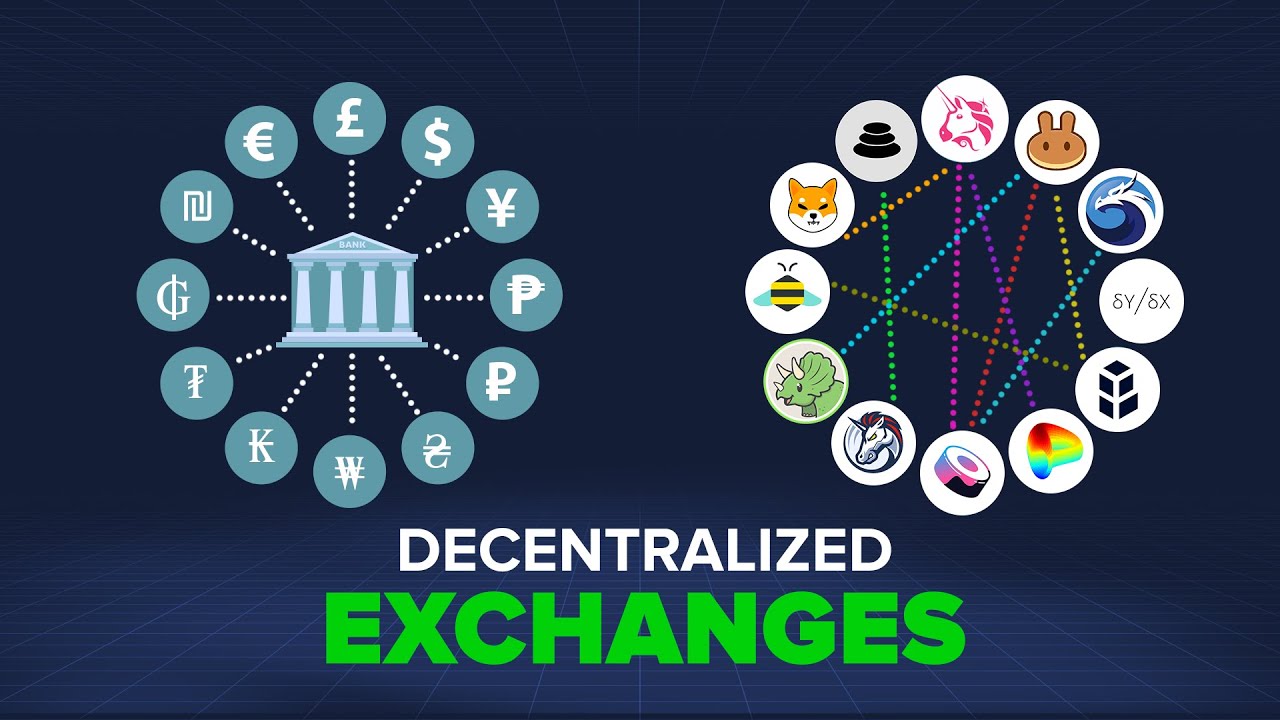

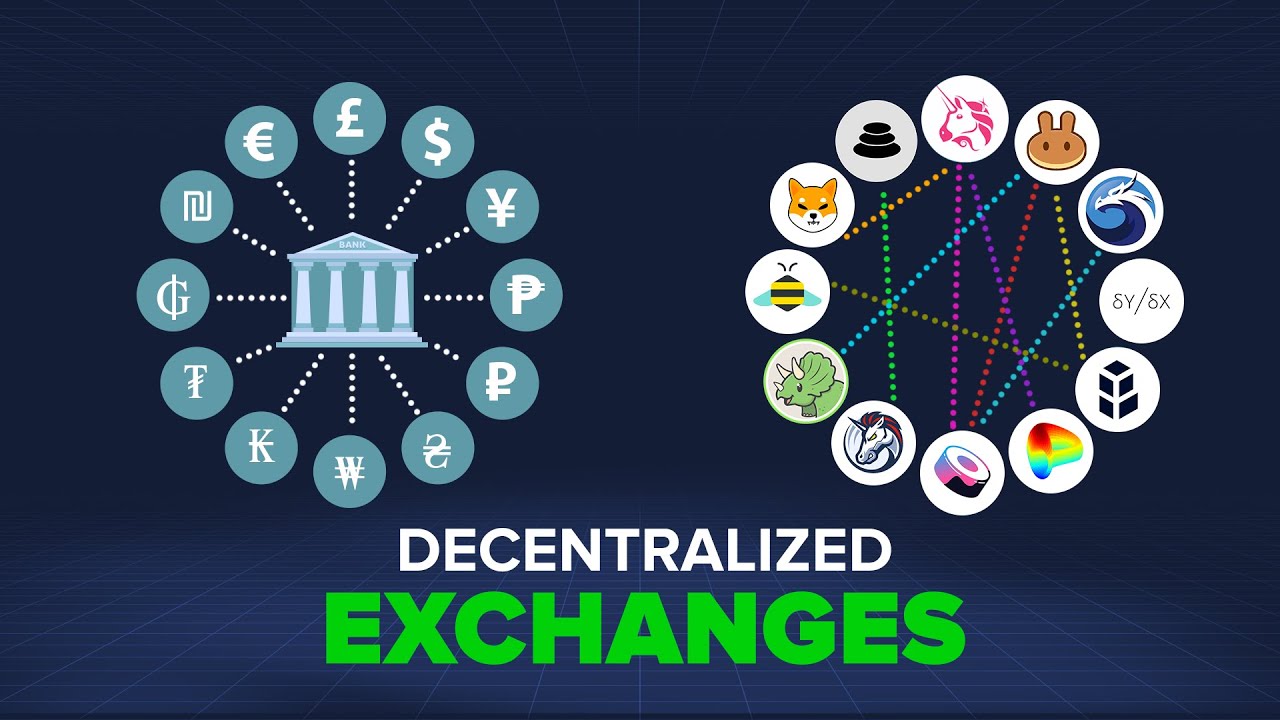

Buyers and sellers of cryptocurrencies can conduct transactions on Decentralized exchanges (DEXs), and Autonomous Decentralized applications (DApps), without handing over any of their money to a middleman or custodian.

This type of infrastructure is quite distinct from the exchanges that customers use to transfer their cryptocurrency holdings when they act as a custodian and centralize the exchanges. These kinds of advantages are what have made DEXs so popular in recent years. DEXs are able to ensure the security of transactions by utilizing smart contracts, which are computer-written agreements that can carry out their own terms automatically. DEXs are able to operate automated order books and transactions thanks to the assistance of smart contracts. They are, therefore “really peer-to-peer,”

How Do Decentralized Exchanges Operate?

Decentralized exchanges primarily serve as connectors by acting as brokers between buyers and sellers. With the help of blockchain technology protocols, DEXs also offer additional security to protect both parties’ data, potentially reducing the need for third parties and granting freedom from the government.

The majority of companies prefer to swap cryptocurrency utilising Binance, but you must first completely comprehend how Decentralized exchanges work. Using a Decentralized exchange development platform, a blockchain technology or distributed ledger can assume the role of a third party. by carrying out important activities using blockchain technology. The core technology that underpins cryptocurrencies lowers the likelihood of failure while providing users access to assets.

Several Distinct Forms Of Decentralized Trading Exist, Including:

An AMM, an order book DEX, and a DEX aggregator are the three main types of Decentralized exchanges from which businesses can choose. All of these are used to facilitate on-chain cryptocurrency trading and order execution amongst participants in smart contracts. Let’s find out more about the several DEX types:

Robotic Market Makers (RMM)

One of the top blockchain development firms is considering building an AMM system based on smart contracts. The primary concern for the system is the liquidity issue. It was even brought up to execute deals using smart contracts that stored tokens on the blockchain. which trade information and utilise several platforms to calculate the value of traded goods.

In this case, a smart contract uses liquidity pools, which are asset pools with pre-funded capital. They are required for the proper operation of DEXs that are based on AMM. A few well-known examples of Decentralized applications (DApps) that can be used with AMM DEXs are Bancor, Balancer, Sushi, Curve, and Uniswap.

Buy Book DEXs

The AMM liquidity pool and order book are powered by a multifunctional engine called the order book DEX, which only works when a user request is approved. It will assist in resolving the issue brought on by the financial process’ failure. This book contains several different kinds of DEXs, such as the Gnosis protocol, Loopring, and IDEX. The order book keeps track of all active orders for buying and selling particular asset combinations. Here are the two different categories of order books:

Order Books On-Chain:

A chained order book The Decentralized exchange platform known as DEXs is where open order data is kept on the chain. It might be advantageous when merchants trade their titles using funds obtained from creditors on their websites.

On-chain order books are used by two well-known Decentralized exchanges, Bitshares, and StellarTerm.

Out-Of-Chain Order Books:

The order books of the various Blockchain systems can be pooled using platforms that are known as Decentralized order book off-chain exchanges, or DEX for short. By enabling transaction settlement only on the Blockchain network, it emphasises the need for centralized cryptocurrency exchanges.

Off-chain order books are utilised in trading in order to hasten the process, reduce associated costs, and ensure that transactions are carried out at prices that are satisfactory to the consumers. Decentralized exchanges (DEXs) like EtherDelta, 0x, and Binance DEX are some instances of Decentralized exchanges that use off-chain order books.

The DEX Aggregators

To solve the liquidity issue, DEX aggregators employ a range of protocols and techniques. Any of those platforms are free to handle trades using third-party liquidity sources in addition to their own. All of these projects effectively combine liquidity from numerous DEXs to decrease slippage on bulk orders, enhance swap fees and raise token values. Protecting consumers from price differences and lowering the risk of unsuccessful transactions are the main objectives of DEX aggregators.

One inch, Slingshot, and Matcha or Ox are a few well-known instances of DEX aggregators.

Lasting Thoughts

The rising demand for blockchain technology with Decentralized applications (DApps) and non-fungible token (NFT) development services has led to an increase in the need for a wide variety of other services. Decentralized exchange development has proven to be the most efficient way to get the liquidity required to cover trading expenses. Users of this site have been able to significantly increase their investment returns by placing their bitcoin holdings in liquidity pools.

If you want to build this Decentralized applications platform (DApps), Digitalroar Softlabs is one of the best companies. In the age of technology, you could be able to grow your business with the help of this development company. A talented blockchain development team could create your platform and provide first-rate services.